A habit takes 66 days to form on average, but we give up our resolutions way before that. Here’s how to ace your 2023 ‘promises to the self’

January 16th is important date coz Most New year resolution will start falling flat from this Day onwards or some  way before that .

way before that .

Here’s Why ?

Enjoyment is an Important Factor :-

Both enjoyment and importance were important in terms of how successful one would be in sticking to their resolution in the future.

Contrary to popular belief, enjoyment predicted long-term persistence. In other words, we make a fundamental psychological error when we assume that we will stick to the plan to achieve the goal simply because it is clearly important to do so.

What really matters is how much we enjoy our initial efforts to begin a new habit, such as a fitness regimen or a diet change. That’s why Quick wins & accountability Partner or mentor is so important . They keep you going in those odd days & make sure you have those rewards / or quick wins in between.

Read on..

Why New Year Resolutions are necessary in the first place or why we are so bad at sticking to fitness resolutions and health goals :-

According to Professor Seppo Iso-Ahola, changing our lifestyle to improve our chances of living a long and healthy life is surprisingly simple at one level. He emphasizes that a healthy lifestyle consists of only four key health behaviors: regular exercise, no smoking, a healthy diet, and moderate alcohol consumption. According to this study, if people followed only these simple strategies for the rest of their lives, they would live seven years longer.

His study, ‘Conscious-Nonconscious Processing” Explains Why Some People Exercise But Most Don’t,’ delves into understanding why we don’t exercise when we should boils down to understanding what happens when we have to think about the decision to exercise.

How much of this decision is conscious wrestling with yourself over what you should do versus what you really want to do will predict how likely you are to stick to your fitness resolution.

Once you get started and establish a set of health routines, they begin to operate below conscious awareness, so you don’t have to think about them too much. The benefits of exercise then become a positive feedback loop; physical activity improves our self-esteem and directly improves our mental health, well-being, and brain function.

Learning or taking up a new sport, increases brain grey matter. Physical activity increases the size of the hippocampus, the part of the brain dedicated to memory, which improves recall and may even delay or prevent dementia, the report says.

when people get home from work, it is the first time during the day when they feel “it is my time to do whatever I want,” and thus they do not want to be told what to do (i.e., you have to go for a run). This is the last time they want to have to make difficult decisions.

Choosing to exercise at this precise moment is mentally taxing and undermines their sense of freedom for occasional exercisers and non-exercisers, whereas other common leisure activities (e.g., TV watching) do not. As a result, the “law of least effort” is followed while satisfying the fundamental need for autonomy, making couch-potato a formidable psychological barrier for would-be exercisers.

The psychological trick here is for exercise to become a forced “choice”.

Professor Seppo Iso-Ahola refers to this as the systematic construction of a ‘exercise infrastructure’.

This could include, for example, changing your environment to encourage you to exercise. It could mean leaving your gym clothes out on your couch as a nasty reminder of what you should be doing instead of watching TV, or choosing a time of day when there is less competition from other activities you enjoy doing – perhaps first thing in the morning or at lunchtime. Or enlist the help of others to go running with you, so that the knock on the door makes it more difficult to stay in and watch TV.

After a sufficient number of repetitions, exercisers can progress to the point where they make a permanent decision to exercise regardless of daily circumstances.

According to Professor Seppo Iso-Ahola, once a high level of habituality has been attained, it is difficult to break the habit.

Five ways to have Successful Resolutions :-

A habit takes 66 days to form on average, and education is ineffective at changing behaviour. A review of 47 studies discovered that changing a person’s goals and intentions is relatively easy, but changing their behaviour is much more difficult . Strong habits are frequently activated unconsciously in response to social or environmental cues.

Here are the five tips to help one stick to their New Year’s resolutions:

- Determine your priorities: Willpower is a limited supply. Resisting temptation depletes our willpower, leaving us open to influences that reinforce our impulsive behaviour. We often make the mistake of being overly ambitious with our new year’s resolutions. It is best to prioritise goals and concentrate on one behaviour. Small, incremental changes that replace the habit with a behaviour that provides a similar reward are the best approach. Diets that are too strict, for example, demand a lot of willpower to stick to, the report explains.

- Modify your routines: Routines are where habits are formed. Routine disruption can thus prompt us to adopt new habits. Major life events, such as changing jobs, moving, or having a baby, all promote new habits because we are forced to adapt to new circumstances. Routines can increase productivity and add stability to our social lives, but they should be chosen with caution. People who live alone have stronger routines, so if you do, using a dice to randomise your decision making could help you break your habits.

- Keep track of your actions: “Vigilant monitoring” appears to be the most effective approach to breaking bad habits. This is the stage at which people actively monitor their goals and regulate their behaviour in response to various situations. A meta-analysis of 100 studies found that self-monitoring was the most effective of 26 different strategies for promoting healthy eating and physical activity, the report said.

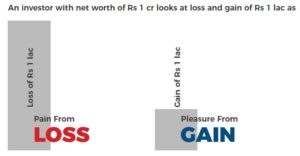

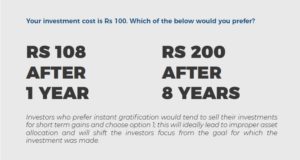

- Visualize yourself in the future: To make better decisions, we must overcome our tendency to prefer rewards now rather than later – a phenomenon known as “present bias” by psychologists. One way to combat this bias is to plan for the future. Our future self is virtuous and pursues long-term goals. Our current self, on the other hand, frequently pursues short-term, situational goals.

- Establish objectives and deadlines: Setting self-imposed deadlines or goals assists us in changing our behaviour and developing new habits. Assume you intend to save a certain amount of money each month. Deadlines are especially effective when they are linked to self-imposed rewards and penalties for good behaviour.

To know more &  be part of for Life changing community that works on “Kaizen” , Register atEWN Growth Multiplier program conducted online every Friday at 8 PM that Covers four pillars of Human aspects (Healthset / Wealthset / Mindset / Careerset ) for your professional &personal growth & success.

be part of for Life changing community that works on “Kaizen” , Register atEWN Growth Multiplier program conducted online every Friday at 8 PM that Covers four pillars of Human aspects (Healthset / Wealthset / Mindset / Careerset ) for your professional &personal growth & success.

Register here at https://zfrmz.in/fv47zYixWmbenKBmBVyV to get a call back from our Team.