Foreword :-

Global markets,India being no exception, have taken a significant beating following the outbreak of Covid-19 pandemic. While an erosion in value of investments does worry an investor, it brings to the forefront two pertinent questions:

- Can you control what is happening in the market?

- Can you control how you react to what is happening in the market?

The answer to the first question is “No”. As far as the second question is concerned, the answer is “Yes”, but it is easier said than done.

Most conventional economic theories that were path-breaking discoveries of the 20th century made a fatal assumption that people are rational, thereby overlooking a key aspect governing human behavior.

Over the last 30 years, a lot of ground has been covered on this subject suggesting that it’s time to accept that humans are emotional and are subject to cognitive biases. These biases, from time to time, come in the way of effective decision making concerning each and every aspect of our life, including personal finances.

In this edition of ‘Know your behavioral biases’ , we have tried to elaborate the biases that individual investors commit, thereby endangering their hard earned wealth. As with most complex problems, the solutions thereof are often simple, and dealing with behavioral biases is no exception. Herein, we present simple yet effective and easy methods to know, accept and overcome these biases.

Index :-

- How to respond to market cycles.

- Loss aversion bias.

- What is mental accounting?.

- Herd Mentality.

- Emotional attachment to inherited wealth: Endowment bias.

- Availability bias.

- Recency bias.

- Unable to bring discipline in investing.

- Is short term thinking a disease?

- Conclusion.

How to Respond to Market Cycles?

Greed and Fear in Market Cycles

Investor’s experience in the markets is one of the most important factors that determines his/her investment decisions. For example, someone who began investing during the negative phase of the markets (e.g. year 2001 – IT Bubble, 2009 – Global Financial crisis) will prefer to avoid equities compared to an individual who has had a good investment experience (year 2010)

Typical Reaction of an Investor – Joining the Dots

Below chart shows how greed and fear overrides investors emotions and how an average retail investor behaves during the ups and downs of the market cycle.

Currently, as the markets have fallen sharply from highs & in the process of again rising , it may not be a right thing to sell-out, instead adopt a long term approach to equity investing. It may even be prudent to go contrarian and make fresh allocations to equities in a staggered manner.

Our emotions often entice us to time the market, while, to make such decisions, we are no more equipped than a gambler before the roll of the next dice. More often than not, these actions driven by emotions are counterproductive. Simply adopting a buy and hold strategy for a long period of time can be more rewarding instead.

Understanding Market Cycles –

Markets are not linear and move in cycles.

Along with the economy and business, markets also go through periodic expansions and contractions. Periods of expansions are characterized by business optimism and increase in business profitability. Conversely, periods of contraction are characterized by business pessimism and decline of business profitability. Markets anticipate these fluctuations and move ahead.

The long term average trends across cycles are typically upward sloping in a growing economy as economies, corporate profits, consumption levels, etc. grow at positive rates in the long run.

From an investors’ perspective, the turning points in business cycles are hugely important. Investors who can position their portfolios in line with the cyclicality of the markets can make a fortune. This is different from timing the market, which can be fraught with risks. Understanding of cycles can help an investor position the overall portfolio with varying allocation to different asset classes. When it comes to individual investments, adopting a systematic Investment route would be ideal.

What to see around you?

Peak of a cycle

- Economy is strong; reports are positive

- Earnings beat expectation

- Media is full of good news

- Everyone around you is confident, optimistic and greedy

- People are ready to take risks

- Defaults are few Skepticism is low Euphoria everywhere

- Di cult to imagine things going wrong

This is the time for caution!

Bottom of a cycle

- Economy is slowing; reports are negative

- Earnings are flat or declining

- Media report only bad news

- Everyone around you is worried, depressed and fearful

- People are not ready to take risks

- Defaults soar Skepticism is high Panic everywhere

- Everyone assumes things will get worse

This is the time for aggression!

Is it time to be aggressive or defensive?

Loss Aversion Bias

Losses are felt much more than gains of similar value. People do not treat gains and losses in a linear way. It feels better to not lose Rs.100 than to gain Rs.100

I hate losing more than I love winning . Loss aversion is the tendency to avoid loss over maximizing gains.

Lets consider 2 scenarios:

Scenario 1:

While you are walking, you find a Rs 500 note lying on the ground. You pocket it and feel happy about it.

Scenario 2:

While you are walking, you find a Rs 2000 note lying on the ground. You pocket it and subsequently someone picks your pocket and you loose Rs 1500 (say from other pocket)

Which scenario will make you happier? Payoff from both the above scenarios are same but the emotional outcomes are different. A loss of Rs 1500 gave you more pain than gain of Rs 2000.

Similar experience is observed in investing; consider the below scenarios:

Scenario 1 :- Investment with cost price of Rs 1000 is sold at Rs 2000

Scenario 2 :- Same investment has touched a high of say Rs 3000 and is now trading at say Rs 2000, the pain from notional loss of Rs 1000 will be much more compared to the overall gain on the investment.

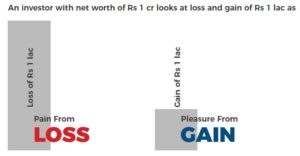

An investor with net worth of Rs 1 cr looks at loss and gain of Rs 1 lac as

This is evident from the fact that investors prefer Fixed Deposits over instruments with variable returns but with an ability to beat inflation more effectively.

Pain or Joy, We Remember only Extreme Cases

We all prefer pain to be brief and joy to last longer. Lets consider the below example where you are under medication and have to undergo either of the two options below:

Scenario 1 :- An injection every day for the next 20 days

Scenario 2 :- An injection, which is 20% more painful, everyday for the next 12 days

Individuals tend to remember the intensity of the pain whereas duration of Pain / Joy is often ignored. Since under option 2, pain is 20% higher, most individuals will prefer option 1.

Similarly, in investments, time correction does not affect emotions as much as price correction. Investors often remember negative events like “Black Mondays”, “Tragic Tuesdays”, etc. Investors often ignore the fact that a big fall in markets on a single day followed by a slow recovery is similar to markets staying flat/ remaining range bound mode over a year.

EMI schemes, Personal Loans, Women’s Kitty Party all follow similar concept.

How to Deal with Loss Aversion Bias?

- Free yourself of emotions as much as possible

- Do not invest directly in volatile asset classes like equity

- Choose a professional fund manager

- Also take the help of an Investment Advisor

- Adopt a portfolio approach and do not focus too much on each individual investment. Leave the job of product/scheme selection to the Investment Advisor

- Investing is better left to experts.

- Mutual Funds (MFs) are cost effective and convenient.

What is Mental Accounting?

It shows how individuals separate their budget into different accounts for specific purposes.

Mental Accounting : Money Jar Fallacy

Mental accounting, a behavioral economics concept introduced in 1999 by Nobel Prize-winning economist Richard Thaler, refers to different values people place on money, based on subjective criteria, that often has detrimental results.

The concept of mental accounting is beautifully explained by Thaler and Cass Sunstein in their book Nudge: Improving Decisions About Health, Wealth and Happiness through the example of Hollywood actors Gene Hackman and Dustin Hoffman .

Mental Accounting and Investments :-

People also tend to experience mental accounting bias in investing. When it comes to investing, mental accounting can also cause people to make illogical decisions.

Investors invest their wealth based on the source of income. Higher weight-age is given to hard earned money like salary as investors usually prefer to take lower risk while investing their salary income. An investor who is young should ideally have a higher portion of his/her wealth in equities. However, since there is a emotional attachment to hard earned money; he may not be willing to invest a larger portion of his salary income in equities. (as equities are perceived as risky asset class). The same investor when faced with windfall gains tend to take higher risk with that amount.

Value of money remains the same for an investment made on the advice of a distributor or through own research. However, when evaluating a loss making investment, investors tend to hold on to the same forever if the initial decision to buy was that of the investor himself / herself (as booking a loss hurts his ego). The emotion of regret is in play here. On the other hand, if the initial decision to buy the investment was as per the recommendation of another person, say, the advisor, the investor would be willing to sell the asset at some point and move on. This decision to sell is taken at the cost of diversification.

To avoid the mental accounting bias, individuals should treat money as perfectly fungible when they allocate among different accounts, be it a budget account (everyday living expenses), a discretionary spending account, or a wealth account (savings and investments). But it is easier said than done.

Other Examples of mental accounting :-

Overspending on credit card rather than cash

More impulsive buying on a shopping trip could be attributed to the use of credit cards as compared to giving away cash. However, ‘money’ is ‘money’.

Tax Refunds

Tendency to treat tax refunds as a windfall gain and use it for discretionary spending.

Categorizing money as “Safety Capital” and “Risk Capital”

Investors often categorize portions of their wealth as “Safety Capital”, something that they can never afford to lose (example – salary) and “Risk Capital”, money that they OK to see depreciate, (example – windfall gains).

Money that you “don’t mind losing”

Investors, at times, invest in safe instruments and transfer the appreciation thereof to riskier asset classes, with the mindset that this component is something that they don’t mind losing?

Yearly bonus

Habit of treating yearly bonus differently to monthly salary and spending it lavishly. This behavior is like that of a kid spending birthday money on immediate gratification.

Would you spend your EPFO corpus on a foreign holiday?

There is a guilt factor associated with spending money earmarked for an important goal like retirement planning on a lavish need.

Use Mental Accounting to Your Advantage

Invest with a Goal!

Once you attach a goal to a particular investment, you mentally allocate that money to a particular purpose. Further, it:

Mutual Fund schemes are available for specific financial goals like Retirement Planning and Children’s Education, as defined by SEBI in mutual fund categorization.

Herd Mentality

It is the phenomenon where investors follow what other investors are doing, rather than following their own analysis and risk appetite and is often driven by the fear of missing out

Fear of Missing Out – Have you felt that?

It is normal to get tempted by prospect of becoming rich quickly. When the markets are on their way up, it gets very frustrating for an onlooker to see people create wealth just by being invested in the market. More often than not, a prospective investor gets enticed to invest when he sees quick gains being made by others around him.

This mentality is often the result of a reaction to peer pressure which makes investors act in order to avoid ‘feeling left out’ or ‘left behind’ from the group. In the quest to earn quick gains from his investments, investors often chase returns by following the herd.

In the process of following the herd, investors usually end up with the portfolio that is more risky and may not be appropriate as per his/her risk appetite. The outcome has always been a disappointment in terms of returns.

A classic example of herd behavior occurred in the late 1990s. Investors followed the crowd and invested in stocks of IT companies, even though many of them were loss making and were unlikely to generate significant revenues in the foreseeable future.

Herding = Lazy Thinking :-

It is often observed that investors confidence level, index level and equity allocation usually move in tandem and the result has been the largest chunk of their wealth is invested almost at the peak of the cycle.

Investors that follow the herd are left disappointed to see negative returns at the end of the cycle. This is mainly because investors focus turn to the conduct of the herd in search of earning quick returns instead of fundamentals of the economy, company, etc. that might be more relevant.

Let Asset Allocation Guide You to Overcome Biases :-

Who is happiest during this current episode of equity market volatility?

The answer to this question would be the one who had done asset allocation to some extent. An investor with higher than required equity exposure, obviously, has reasons to worry as the value erosion in portfolio would be felt the maximum. On the other hand, even an investor with zero or very low equity exposure has little reason to rejoice, as it is difficult to take the emotional decision of entering equities in these volatile times, in fact, the investor would strengthen her resolve to never touch equity, an asset class that potentially erode in value in such quick time.

An investor with a more balanced allocation to various asset classes including, equities, fixed income, real estate, gold, etc. is likely to be happiest despite one particular asset class decreasing in value. The very reason to do asset allocation is the uncertain nature of each asset classes and is acknowledgment of preparing for rainy days in a particular asset class.

Source: Bloomberg. Data for last 20 fiscal years. Mar ‘98 to March ’20.

Proxies used for asset classes: Equity – NIFTY 50, Debt – NIFTY 10 year benchmark G Sec, Gold – Spot Rate ₹10 /Grams

Emotional Attachment to Inherited Wealth: Endowment Bias

causes individuals to value an owned object higher, often irrationally

How to treat Inherited Investments?

You recently inherited a flat worth Rs 3 cr from your grandfather.

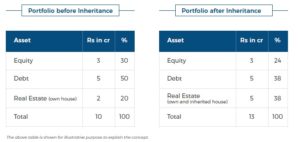

Investors are emotionally attached to the inherited asset and give a higher weightage to such asset in their portfolio and without considering its usefulness in the overall asset allocation, they continue to hold on to the asset.

In the above example, an investor had inherited a flat worth Rs 3cr from his grandfather; continuing to hold on to the flat changed its asset allocation significantly.

Investors should treat the inherited investment under one portfolio and “gradually” change the asset allocation as per his/her risk profile. Investors should ask “Would they make the same investment with new money today?”

Asset Allocation is Key to Financial Success

- Asset Allocation helps overcome emotional attachment to inherited assets

- Each asset class has a different Return-Risk-Liquidity profile

- Diversification is needed to achieve optimal balance between rewards and risks

- Asset allocation decision is the most important factor for long-term wealth building

- There is no “one size fits all” formula for asset allocation. One needs to take professional help during this important step of financial planning.

Availability Bias

is a mental shortcut that

- Relies heavily on information that is easily available to the investor or

- Places undue emphasis on immediate examples that come to mind when evaluating a decision.

Availability bias

Availability bias is the human tendency to think of events that come readily to mind; thus making such events more representative than is actually the case. Naturally, things that are most memorable can be brought to mind most quickly. People tend to remember vivid events like plane crashes and lottery wins, leading some of us to overestimate the likelihood that our plane will crash or, more optimistically — but equally erroneously — that we will win the lottery.

A study by Karlsson, Loewenstein, and Ariely (2008) showed that people are more likely to purchase insurance to protect themselves after experiencing a natural disaster than they are to purchase insurance before such a disaster happens.

Similarly, in investments, negative events that have led to severe market corrections are always at the top of investor’s mind. However, investors tend to ignore market performance post the sharp correction. Few examples of such events – DoT com burst, 2004 crash after formation of new Government, Global Financial Crisis, Greece Sovereign Crisis, Chinese devaluation in 2015.

‘Perceived Risk’ is often higher than ‘Real Risk’ during such events.

Implications of this bias

Investors tend to stay away from markets during such scenarios which leads to:

How to deal with such bias?

We have seen a significant fall in equity markets over the past few weeks as Covid-19 has become the single-point matter of focus among investors. These are, no doubt, tough times as entire humanity is battling the virus pandemic deploying every tool at its disposal to save lives. With a significant chunk of the human population in lockdown, the global economy is expected to take a major hit, and the impact of which is being felt across global stock markets.

This is neither the first time or nor will it be the last time, the Indian stock markets are undergoing such sharp corrections. 1992, 2001 and 2008 were years in which, markets saw even sharper crashes, with underlying reasons different from one another. However, one common variable among these instances was the bounce back witnessed by market in each of these occasions over a period of time. This leads us to a question.

Do we expect Covid-19 to grab headlines one year from now like the way it is doing now?

As the virus scare alleviates over a period of time with the economy coming back to normalcy, the stock markets are also expected to stage recovery. This makes a strong case for investing in equities by spreading them over the next few months. Investors should use such events as buying opportunities and invest with a long term view.

As a case in point, an investor who simply invested through SIPs throughout the ups and downs of the 2008 crisis and subsequent recovery would have performed well without undergoing much of the emotions.

Investors should consult their financial advisors on how to deal with such events.

Missed best days !!

The above chart shows that if you had stayed fully invested in stocks (as measured by the S&P BSE Sensex) from January 1, 1990 to March 310, 2020, you would have earned compounded annual returns of 12.73%.

However, if you had tried to time the ups and downs of the market, you would have risked missing out on days that registered some of the biggest gains, and the CAGR would have dropped drastically: 9.06% if you missed 10 best days, 6.56% if you missed 20 best days, 4.46% if you missed 30 best days and 2.56% if you missed 40 best days during this period.

CAGR – Compounded Annual Growth Rate

Best days means the days on which the markets have given highest returns. Daily returns are considered for determining best days.

Recency Bias

is the tendency to weigh recent events more heavily than earlier events.

How Recent events overtake our investment decisions?

Investors often overemphasize more recent events than those in the near or distant past.

Thus, shifting focus towards the asset class in favor today. This happens as investors have the tendency to extrapolate recent experience into the future which can have disastrous consequences. The result is, it skews our view of reality and the future.

We have seen many such events in India and investors either tend to be overweight or shy away from the trending asset class. Few recent events in Indian context are mentioned below:

Implications of this bias

Investors get swayed by recent events and tend to be either overweight or underweight the asset class in favor/out of favor; thus leading to inappropriate asset allocation.

The overall risk in the portfolio also increases drastically as investors often swing their portfolios to extremes during such situations with the hope that the trend will continue in future.

Recency Bias: Lane Changing doesn’t work

Investors often focus only on the recent 1 year track record of returns when selecting a fund, rather than analyzing the process of investment manager. Thus, making investment decisions based upon the outcome and ignoring the process that led to that result.

The above chart depicts the ranking of the funds over the past 10 years; it can be observed that chasing the best performing fund of a particular year does not work in the long run.

How to deal with such bias?

Investors should follow the advice of a professional, should not invest directly and should have an asset allocation strategy.

Investors should not get swayed away by the past returns and should ideally look at risk statistics, the investment process, the number of securities purchased and other fundamental factors when selecting an investment manager.

Investors should follow a portfolio approach and diversify across various investments.

Unable to Bring Discipline in Investing !

Spending habits can impact long term wealth

Studies have shown that spending tends to be greater when consumers use credit cards rather than cash, due in part to certain behavioral cues that using credit cards may create. One effect is that a credit card “decouples” the act of purchasing from the consumer’s wealth – “get it now, pay later.” – study by RA Feinberg (1986)

People do not act in their best long-term interest because they lack self control. Often people prefer high standards of living in the present, rather than saving for retirement. People who suffer from self-control bias often spend today and sacrifice their retirement, and do not invest in equities or take part in the benefits of rupee-cost averaging.

Recent trend in India’s household savings and household debt also confirms such behavior where investors prefer to live in the present, rather than securing their future.

The “save more tomorrow program” is a classic example to counter such behavior which automatically increased savings rates for plan participants each year. (80% remained in the plan through three pay raises). This is a great way to counteract the natural tendency of people who suffer from self-control bias.

Solution?

Again the magic tool – SIP

- The concept of SIP is in a way similar to “Save More Tomorrow” Campaign

- By enrolling into an SIP, you make a commitment to save a particular amount of money every month for the next ‘n’ number of months

- The amount that is mentally earmarked for SIP helps us to avoid expenses on extravagant / lavish needs, thereby bringing in discipline

- SIP Top up can also be used a tool to overcome this bias – SIP Top up allows you to increase the amount of the SIP Installment by a fixed amount at pre-defined intervals. This facility enhances the flexibility of the investor to invest higher amounts during the tenure of the SIP

Is Short Term Thinking a Disease?

What Makes Us Think Short Term?

Professor Walter Mischel, then a professor at Stanford University, conducted one of psychology’s classic behavioral experiments on deferred gratification named “marshmallow test”. Deferred gratification refers to an individual’s ability to wait in order to achieve a desired object or outcome. The study concluded that individuals that tend to delay gratification were less likely to show extreme aggression and less likely to over-react if they became anxious.

Similar analogy can be drawn to the field of investments wherein investors over react to short term market movements and tend to redeem their investments for short term gains.

What Makes Us Think Short Term?

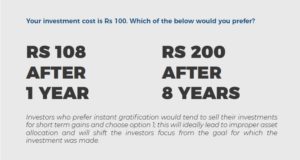

Implications of this bias :-

Investors tend to invest with a short term view and focus shifts away from the goal for which investment was made

How to deal with such bias ?

Investors should do goal-based investing. Invest in equities with a long term view. For short to medium term goals, consider debt funds.

To Conclude

For all its limitless powers of imagination, miraculous artistic capabilities, never-ending endeavor for excellence and boundless achievements over the millennia, the ‘human mind’ is neither free from its delusions nor is it resistant to making embarrassing misjudgments. Our mind occasionally lets us down when it comes to data taking and analyzing in a complex world – the world of investing is no different.

When it comes to decision making, whether it is choosing a word in a game of Scrabble, zeroing- in on next holiday destination or whether to invest in a stock, we try our best to rely on facts and data, while topping it up with a human touch in the form of our best judgments, hunches, intuitions and insights. It is undeniable that emotions like greed and fear are involved when an individual investor makes decisions as represented by inflows at the time of market highs and outflows during a market fall.

Even great investing minds give in to emotions. Harry Markowitz, father of Modern Portfolio Theory and a Nobel Prize winner in Economic Sciences, was once asked as to what was the asset allocation in his personal portfolio. He famously replied “It’s a 50:50 split between equities and bonds as I visualized my grief if the stock market went way up and I wasn’t in it—or if it went way down and I was completely in it. My intention was to minimize my future regret”. This is an example of one of the best ever minds in the world of finance admitting and accepting human fallacies.

Thankfully the solutions to overcome these emotional reactions are astonishingly simple. The key messages of this as detailed above is to embrace the basics like focus on asset allocation, investing through Systematic Plan, investing with a goal and to take help of an advisor. It is exactly these ‘sticking to the basics’ approach that can shield us from the urge to act frequently, to free ourselves from emotions while making decisions and help us stay focused on the path of long-term wealth creation.

Disclaimer

This Content is for information purposes only and does not constitute advice or offer to sell/purchase of any company product. The information and content provided needs to be read from an investment awareness and education perspective only.

Website: www.nayakfin.com